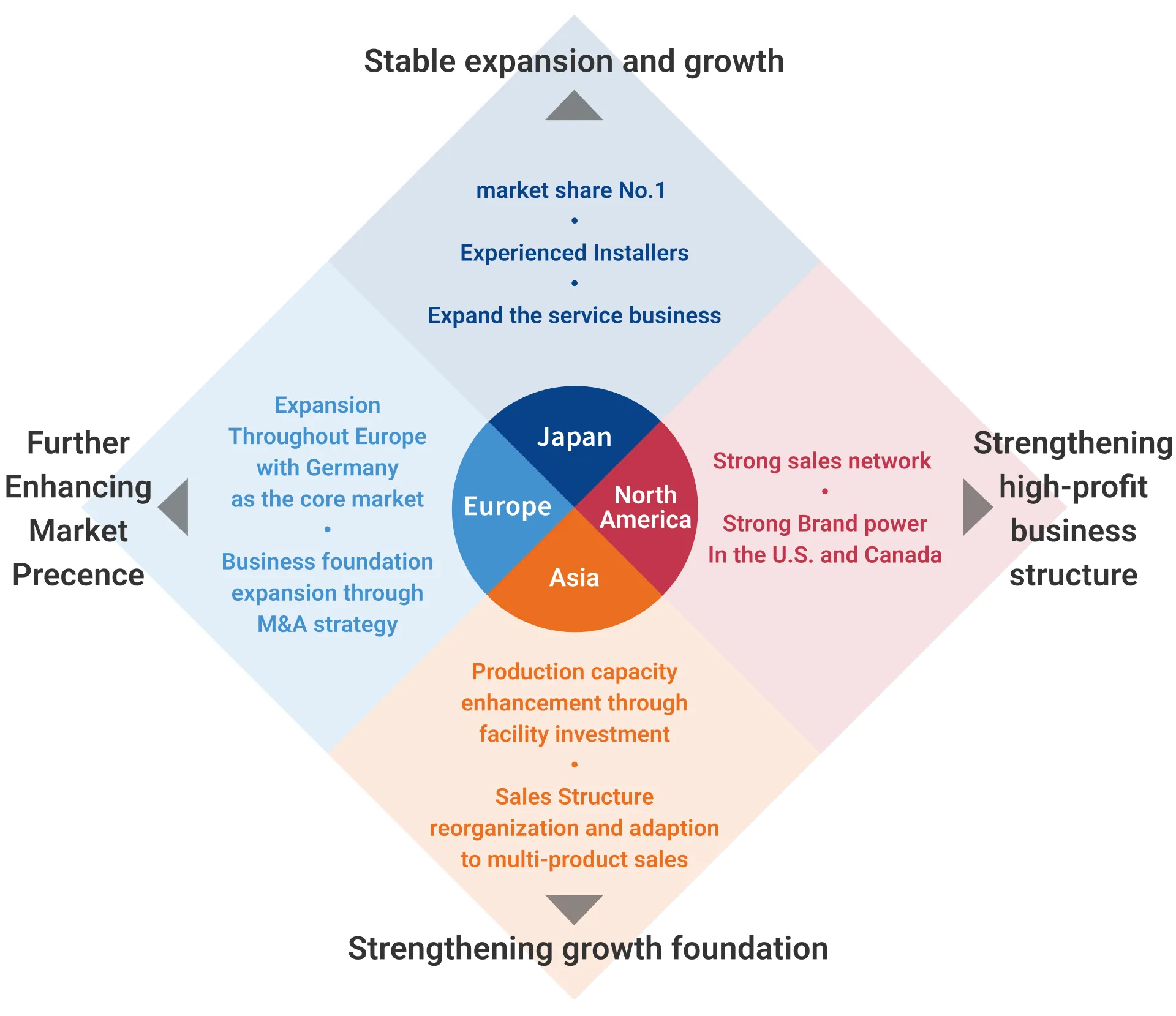

The Sanwa Group's Global Strategies

Since we established SANWA SHUTTER (HK) LTD. in 1986, the Sanwa Group has been pursuing global expansion ahead of other Japanese companies in the industry. As a Global Leader of Smart Entrance Solutions, we conduct business in 28 countries and regions worldwide, with a particularly strong presence in our three major regions of Japan, North America and Europe.

Japan

Net sales

287.7 billion yen

FY2024

Main Products

- shutters

- Steel doors

- Partitions

- Aluminum & stainless steel facades

Number of installers

Over 3,900

Brands

Industry Characteristics / Market Environment

The shutter industry in Japan is characterized by an oligopoly where our company and three others account for approximately 90% market share in both heavy-duty shutters (relatively large shutters for buildings, factories, and warehouses) and lightweight shutters (relatively small shutters for garages and retail stores). Heavy-duty shutters are showing an upward trend due to recovery in non-residential construction investment and the expansion of e-commerce. Lightweight shutters, which were originally intended mainly for individual shops, have been increasingly installed for residential garages in recent years. Additionally, demand for our "TAIFUU Guard Series" and "Water Guard Series" is rising as countermeasures against increasingly severe typhoons and heavy rainfall.

In contrast, the door industry is characterized by a larger number of small-scale manufacturers compared to the shutter industry. While our company operates primarily on a made-to-order basis, there are also manufacturers that produce standardized products.

Regarding the market environment, demand continues to expand, particularly for office doors, driven by large-scale redevelopment projects mainly in the Tokyo metropolitan area.

Strategies

We are now working to strengthen our core business, expand our disaster prevention, mitigation, and climate change response products, promote IoT automation, and expand our service business. We also aim to extend our business domain into related and peripheral areas of these core businesses. To strengthen our organizational structure for business expansion, we will focus on enhancing human capital development, improving productivity, and strengthening installation, manufacturing, and supply capabilities.

North America

Net sales

1,613 Millions of US dollars

FY2024

Main Products

- Garage doors

- Industrial sectional doors

- Commercial Shutters

- Door openers

Number of distributors

Approximately 450

Brands

Industry Characteristics / Market Environment

While shutters in Japan are typically stored by rolling them up into a case installed above an opening, the mainstream type in North America and Europe consists of horizontally connected panels that slide horizontally along rails to the ceiling. These products are not made-to-order like those in Japan, particularly garage doors are predominantly standardized products.

Strategies

In our North American operations, we will continue to strengthen and grow our core businesses while expanding into peripheral businesses. We are implementing measures to strengthen sales channels to increase sales in major metropolitan areas such as New York, where Overhead Door Corporation (ODC) has a relatively low market share and room for development. We are also expanding our product lineup for both residential and industrial applications. Additionally, we are reviewing manufacturing operations and optimizing production sites to improve manufacturing efficiency. In January 2023, we acquired Door Control, Inc. and others to further advance growth and sales expansion in the automatic door service and installation business in North America.

Europe

Net sales

696 million euro

FY2024

Main Products

- Garage doors

- Steel Hinge Door

- Industrial sectional doors

- Docking Solutions

Service Business Sales

101 million euro

FY2024

Brand

Industry Characteristics / Market Environment

In the European hinged door, garage door, and industrial door industries, needs vary in terms of design and thermal insulation performance due to differences in culture, customs, and climate across European countries.

Strategies

In our European operations, we are strongly promoting structural reforms while pursuing integration synergies with acquired companies and aggressively expanding our service business to enhance our presence in the European market. Specifically, to increase sectional door production capacity, we have expanded Alpha Deuren's plant in the Netherlands, making it one of the largest industrial sectional door factories in the European market. We have also expanded the production capacity of dock levelers manufactured at our Polish factory to meet strong demand. For our service business, we will focus on the non-residential sector in countries such as France and Germany. With the acquisition of Robust AB in May 2019, we are expanding sales in the Nordic region and the UK. Additionally, in October 2021, with the acquisition of Manuregion S.A.S in France, we are enhancing our sales network and expanding our service business in France.

Asia

Net sales

15.4 billion yen*

FY2024

Main Products

- shutters

- Steel doors

Countries & Regions

China, Taiwan, Hong Kong, Vietnam, Thailand, Indonesia, Korea

- Companies to be consolidated: SHANGHAI BAOCHAN, Sanwa Novoferm (Changshu), Sanwa Holdings (Shanghai) , AN HO METAL INDUSTRIAL, SANWA SHUTTER (HK), SUZUKI SHUTTER (HK), AUB, VINA-SANWA

Industry Characteristics / Market Environment

Our group has expanded into the Asian region, including China and ASEAN countries, with total sales of approximately 15 billion yen. In this region, unlike our group companies in North America and Europe, we have primarily established joint ventures (JVs) with local capital rather than acquiring local companies, with some exceptions. Therefore, we need to build sales channels and train installers on our own.

Strategies

We are currently focusing on establishing foundations in each market and promoting growth enhancement. We are preparing to advance to the next stage by further promoting localization, strengthening cooperation among group companies, and pursuing cross-regional business opportunities within Asia. We are working to build a foundation for Asia to become our fourth pillar after Japan, North America, and Europe by significantly increasing production capacity through facility enhancement and by reviewing sales systems and promoting product diversification.

From FY2019, we consolidated four companies (Shanghai Baochan-Sanwa Door in China, An Ho Metal Industrial in Taiwan, Sanwa Shutter in Hong Kong, and Vina-Sanwa Vietnam), and from FY2020, we consolidated Suzuki Shutter in Hong Kong. In August 2022, we made our first M&A in Asia by acquiring AUB in Hong Kong, promoting the expansion of our group's service and customer base in the industrial shutter/door access market in Hong Kong and Macau.

From FY2023, we have consolidated Sanwa NF Changshu, a newly established door plant that enhances our production capacity.