Medium-term Management Plan

To be a Global Leader of Smart Entrance Solutions

Positioning

Strengthen and expand a foundation toward becoming a global leader in high-performance entrance solutions to meet the changing needs of society due to climate change and digitalization.

Basic Strategies

- Strengthen and expand core businesses in Japan, North America, and Europe

- Grow Asian business with solid profits

- Expand business through disaster preparedness products, climate change response products, and smart products and services

- Increase productivity and expand production capacity through digitalization and manufacturing innovation

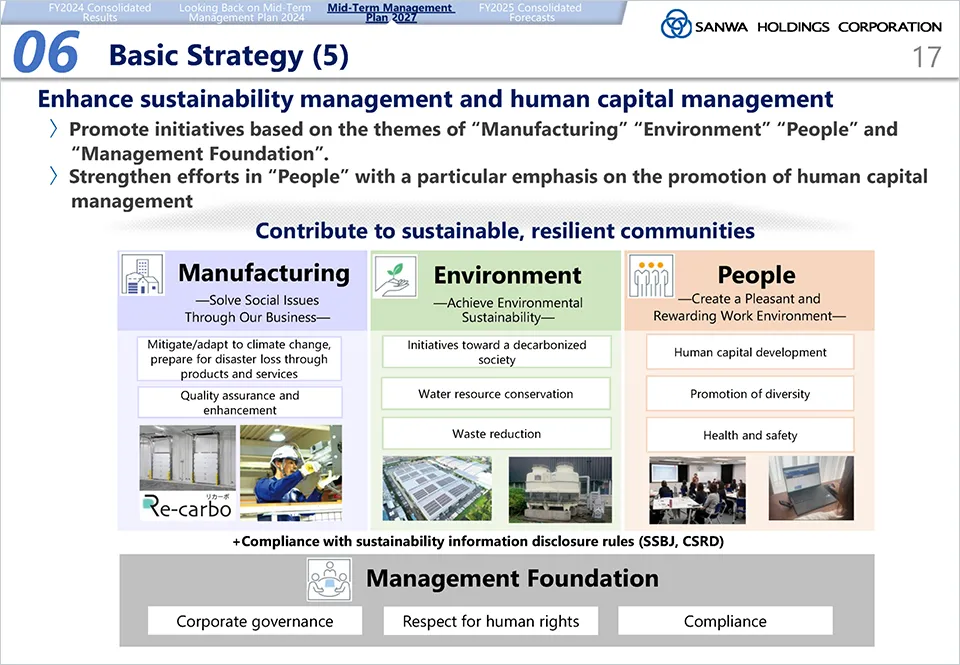

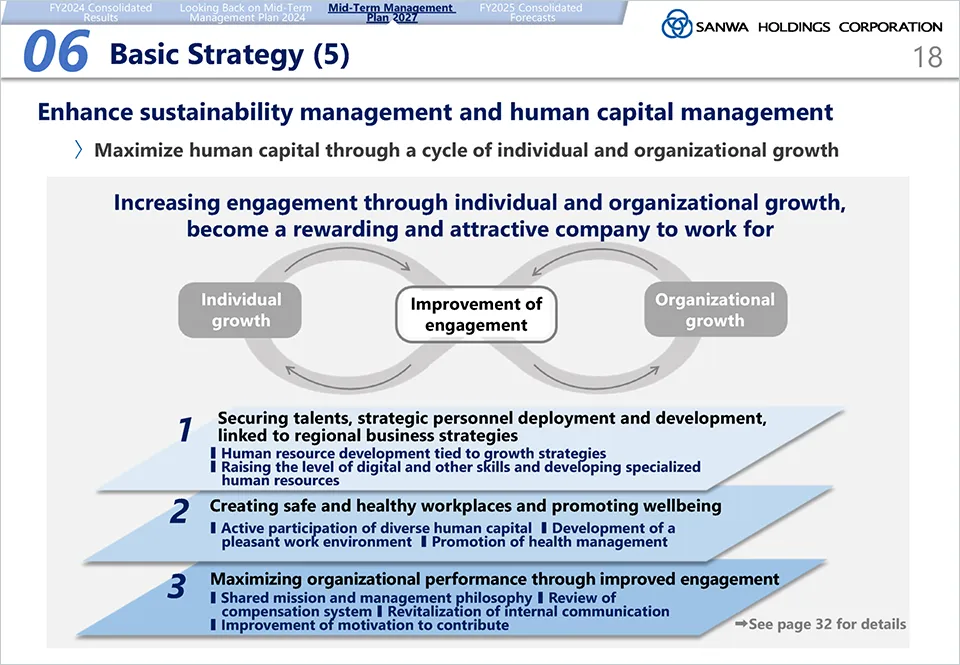

- Enhance sustainability management and human capital management

Numerical Target

Net Sales

750.0billion

CAGR +4.2%

Operating Income

Before amortization of goodwill

100.0billion

CAGR +7.5%

Operating Income Ratio

Before amortization of goodwill

13.3%

ROE

19.0%

SVA

45.0billion

ROIC

18.5%

Principles for Cash Flow Allocation

Investment is the highest priority in order to realize sustainable growth.

Shareholder returns

Target DOE (dividend on equity) to 8%

We give preference to investments but will flexibly repurchase treasury stocks if there are no substantial cash outflows related to such investments.

Capital investment

In principle, we make capital investments necessary for maintaining and continuing core businesses within the range of depreciation.

Strategic investment

We preferentially consider strategic growth investments such as capital investments to strengthen production capacity and improve productivity, promotion of digitalization, M&A investments in core businesses and in related fields to complement core businesses.