Business-related Risks

The Group ensures stable business management by implementing a Group-wide risk management system and working to predict and prevent potential risks, as well as by responding appropriately through measures to counter risks as required for business continuity.

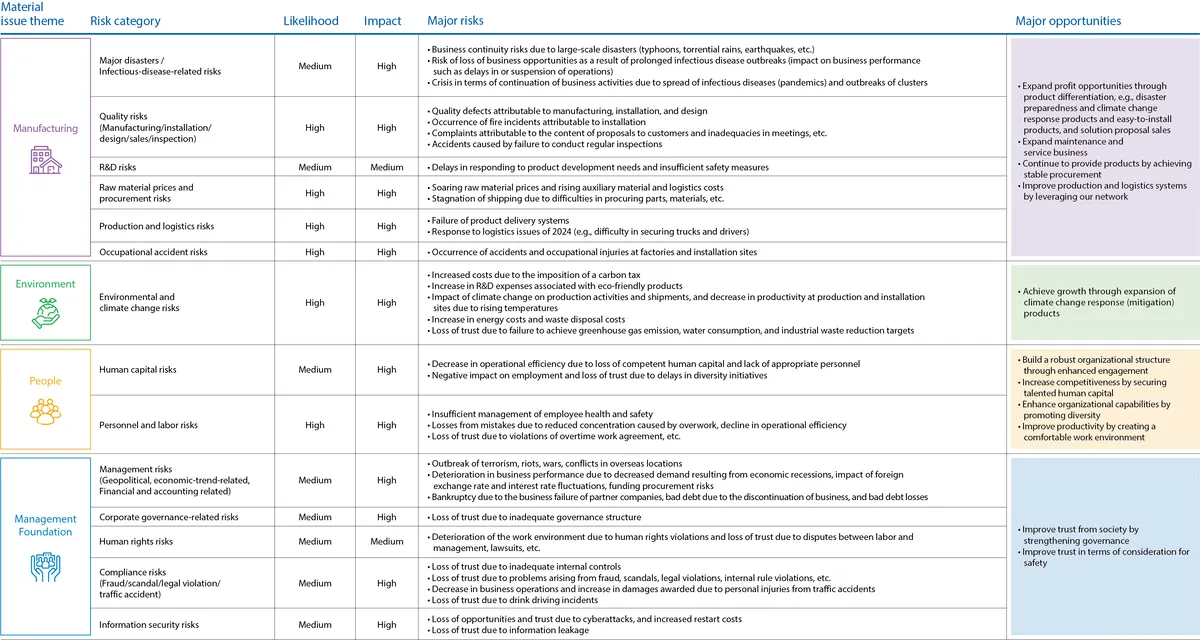

Major risks and opportunities and responses

The Sustainability Committee, chaired by the Representative Director and President and dedicated to promoting risk management, reports and deliberates on the Sanwa Group's basic risk management policies, risk management-related plans, and the progress of initiatives.

The major risks are classified into the categories of manufacturing, environment, people, and management foundation of the Group, and each risk and opportunity, as well as measures to handle them, are described.

Details of the risks are described in "Business Risks" in the Annual Securities Report (Japanese Only).

For further details, please refer to the "Integrated Report 2025: Risks and Opportunities (Detailed Edition)."[127KB]