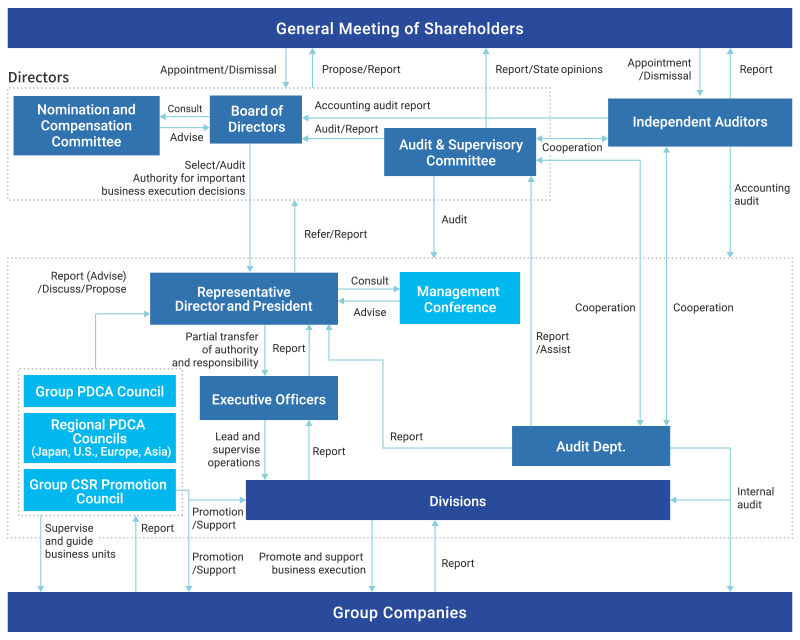

Corporate Governance Structure

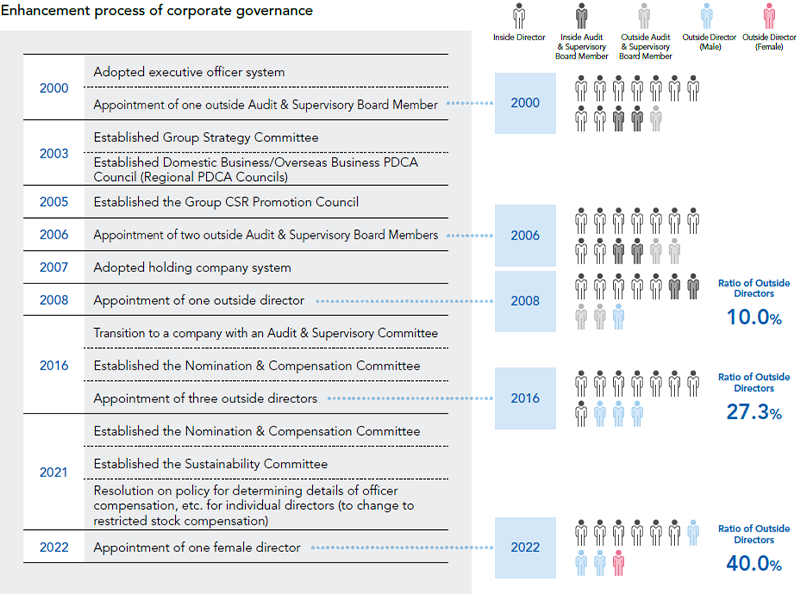

Timeline of Corporate Governance Reforms

Policy for Selection of Outside Directors

We appoint outside directors based on our overall judgment of a number of considerations using information such as candidates’ career histories and the relationship of their previous employers with the Company. Judgment criteria include whether there are any issues regarding their independence from the Company, and whether the candidates are qualified to perform the monitoring and supervision functions that the Company requires of outside directors based on their personality, insight and background. The Company stipulates independence criteria for outside officers. For details, please see the Company’s website.

Independence Criteria for Outside Officers

Corporate Governance Guidelines

Established to fulfill our responsibilities to all our shareholders, these guidelines clarify the Company’s basic approach to corpo-rate governance. We clarify what the Company specifically has to address to achieve sustainable growth and increases in cor-porate value over the medium to long term.

Please see the section “Corporate Governance Guidelines” posted on our website.following reason set out below.

Corporate Governance Guidelines(PDF)

Established July 1, 2019

Revised May 13, 2024

Chapter 1 General Provisions

Sanwa Holdings Corporation (the “Company”) is a global enterprise in the access systems industry with operations in Japan, the United States, Europe and Asia. As such, the Company aims for sustainable growth and enhanced corporate value through sincere and fair business activities in accordance with the following Mission, Values, Principles of Business, and Compliance Code of Conduct, thereby to contribute to the sustainable development of society. As the foundation for this, we position corporate governance as an important management issue, and will strive to establish highly transparent Group management.

(Our Mission)

The Sanwa Group is committed to offering products and services that provide safety, security and convenience to further contribute to the prosperity of society.

(Our Values)

- To deliver products and services to satisfy all customers.

- To become a true global player and be highly valued in each market in the world.

- To bring together the creativity of each individual in a team environment for the enhancement of corporate value.

(Principles of Business)

- We implement business activities with appreciation and sincerity to increase our customers’ trust.

- We produce products with good quality and reasonable cost meeting domestic and overseas needs and thereby establish the leading brand.

- We forecast our customers’ future needs and always try to improve the technical level and productivity in every division.

- We comply with the rules and make our workplace friendly, open, challenging and rewarding.

- We are driven by inspiration, strive to achieve our high level goals, recognize our roles and responsibilities, and contribute to the creation of corporate value.

(Compliance Code of Conduct)

- The Sanwa Group must conduct company activities with top priority placed on the safety of the products and services that we provide.

- The Sanwa Group will not seek profit through actions that violate the Compliance Code of Conduct.

- All management personnel and supervisors of the Sanwa Group will take the lead in observing the Compliance Code of Conduct, and will act in such a way as to be a good example for the staff under them.

- The Guidelines clarify the Company’s basic approach to Corporate Governance from the perspectives of ensuring the rights and equality of shareholders, ensuring appropriate information disclosure and transparency, the corporate governance structure, and dialogue with shareholders, and are intended to fulfill accountability with all stakeholders, including shareholders.

- The establishment, revision and abolition of the Guidelines shall be by resolution of the Board of Directors. However, minor changes such as wording may be decided by Directors who make significant decisions concerning business execution.

Chapter 2 Ensuring the Rights and Equality of Shareholders

- The basic policy of the Company is to use the general meeting of shareholders as a venue for dialogue with shareholders, where the Company endeavors to convey the status of business, issues to be addressed, and the details of proposals to shareholders in an easy-to-understand manner, and provides full explanations to shareholders, including by way of questions and answers. In addition, in order to ensure that shareholders have sufficient time to study the proposals for the general meeting of shareholders and are able to appropriately exercise their voting rights, the Company, in principle, sends the convocation notice at least three weeks prior to the date of the general meeting of shareholders and also posts the convocation notice on its website.

- Substantial shareholders, who are not listed in the register of shareholders, are permitted to enter the venue of the general meeting of shareholders as observers as long as it will not disadvantage shareholders who are listed in the register.

- For shareholders who are unable to attend the general meeting of shareholders, the Company adopts a system enabling the exercise of voting rights via the Internet, and further enables the use of a voting rights exercise platform for institutional investors.

- The results of the exercise of voting rights for each proposal presented at the general meeting of shareholders will be compiled in the form of an extraordinary report, and will be disclosed on EDINET, an information disclosure system of the Financial Services Agency, as well as on the Company’s website.

- The Company will strive to ensure the equality of all shareholders by creating an environment in which shareholders can exercise their rights appropriately.

- The Officer responsible for Corporate Planning oversees dialogue with shareholders. The unit responsible for IR serves as the liaison for dialogue with institutional investors, and communicates with the relevant divisions as necessary.

- Opinions received from shareholders and investors are reported regularly to the Board of Directors.

- During the course of any dialogue, due consideration is given to the treatment of important information, including the non-provision of undisclosed important facts that may affect the stock price.

- In order to prevent any leak of information regarding financial results and to ensure fairness, the Company refrains from commenting on the financial results during the period from the day following the settlement date of each quarter until the day of announcement of the financial results.

- The Company endeavors to deepen the understanding of shareholders, through activities such as results briefings by President, the timely disclosure of information on the Company’s website, individual meetings with institutional investors, and seminars for institutional investors.

- The Company’s basic approach on capital policy is to enhance capital efficiency upon ensuring financial stability, and enhance corporate value over the medium to long term while achieving the optimal balance of investment with shareholder returns.

- The payout ratio is determined and announced by the Board of Directors, taking into consideration the current environment and business performance from the perspective of aiming for stable dividends. Real free cash flow (FCF) excluding dividends paid and interest-bearing debt that has reached maturity, will be prioritized for strategic investment, and we will consider share repurchases if there is no net cash to be used in investing activities.

- We will make an appropriate response within the scope of the law to any party intending to carry out a large-scale purchase, including requesting said party to provide necessary and sufficient information to enable shareholders to appropriately determine whether to accept the purchase, announcing the opinions of the Company’s Board of Directors, and making efforts to secure time for shareholders to consider the proposal.

- In the event of a takeover proposal for the purpose of acquiring control of the Company, the Company will make efforts to actively collect information and disclose such information in a timely manner, as well as work to secure and improve its corporate value and the common interests of shareholders.

- The Company will not take any measures to unfairly hinder the rights of shareholders to release shares in response to a tender offer.

- The Company may acquire and hold shares of business partners in order to build good relationships with them and to improve the Company’s corporate value from a medium- to long-term perspective by ensuring smooth business transactions.

- Strategic shareholdings of listed companies will be examined by the Board of Directors for each issue, comparing the benefit against the cost of holding, and the relationship with the Company’s capital cost, and promptly considering the sale of stocks with diminished importance.

- The Company exercises voting rights of strategically held shares, based on comprehensive judgment of matters such as whether the proposal will contribute to the sustainable growth of the issuer and whether it will contribute to the maintenance and enhancement of the Company’s corporate value.

- In the event that a strategic shareholder indicates the intention to sell its shares, the Company will agree to the sale following dialogue with the said shareholder.

- In its business transactions with strategic shareholders, as with other business partners, the Company fully considers economic rationality, including quality and cost.

- The Company established the Sanwa Shutter Corporate Pension Fund, and appropriately operates and manages the Fund by selecting its directors and representatives from Group companies as well as full-time managing directors. With the support of external consultants, important matters will be submitted to the Fund’s Board, to be resolved thereafter at the Board of Representatives based on operational guidelines, so as to avoid any conflict of interest between the beneficiaries and the Company.

- The Company appoints persons with the necessary qualifications for practical operations as the Fund’s full-time managing directors. These managing directors work on stewardship activities in the scope of a corporate pension fund, including by requesting each asset management company to fulfill their stewardship responsibilities, and receiving reports of those results.

Chapter 3 Relationships with Stakeholders Other than Shareholders

The Company positions its mission of offering products and services that provide safety, security and convenience to further contribute to the prosperity of society as the basic principle in our relationships with stakeholders. Divisions work together to define themes and priority issues from the perspective of the satisfaction of shareholders.

- The Company has established the Principles of Business which acts as a guideline that all officers and employees of the Group should keep in mind at all times, and as standards to which each person must adhere when the Company seeks to make an appropriate response to changes in the environment.

- In the Compliance Code of Conduct, the Company sets out policies for compliance to which every officer and employee of the Group must adhere, and works to ensure the penetration of the Code and adherence to it by distributing it to every officer and employee of the Group as well as holding compliance training sessions.

In accordance with our basic policy for environmental conservation (Sanwa Group Environmental Policy), the Company conducts business activities in harmony with the global environment and local communities, and contributes to a sustainable and prosperous society as a good corporate citizen.

The Company implements Group-wide risk management to address diversifying risks, and to achieve sustainable growth by earning the trust of stakeholders.

The Company aims to protect precious lives and achieve a more prosperous and comfortable society by offering products and services that provide safety, security and convenience to customers all over the world. We have extensive lineups of products that protect people’s lives from disasters, such as fires and floods, and products that increase the safety of people’s daily lives. Our priority is to produce products that support society and people’s daily lives.

- From the perspective of promoting diversity, we are working to improve internal human resources, including through the deployment of global human resources, the employment of persons with disabilities, and the promotion of women. In addition, in order to promote these initiatives, we are strengthening our efforts to improve work-life balance.

- Specifically, we are focusing on creating a comfortable working environment, including through flextime, a system for modified working hours, and the expansion of shorter working hours. In particular, we are striving to create an environment and system over the medium to long term that enables women to continue working by being able to balance work life and family life.

Chapter 4 Ensuring Appropriate Information Disclosure and Transparency

In accordance with the Disclosure Policy, the Company discloses information in an appropriate manner based on the Companies Act, the Financial Instruments and Exchange Act, and other laws and regulations, and also actively discloses information that is important and reliable for all stakeholders, even when it lies outside of laws and regulations.

The Company endeavors to disclose and provide information in English for the purpose of communicating information to overseas shareholders and investors.

- The Company evaluates the overall capacity of Independent Auditors, including the audit quality, audit system and cost, and also evaluates their independence as well as expertise.

- The Company secures sufficient time for audit to enable Independent Auditors to perform high-quality audits, as well as a venue for conducting direct interviews with the Company’s management.

- In addition to regular meetings held twice a year with the Audit & Supervisory Committee and the internal audit unit, Independent Auditors have the opportunity to share information and exchange information and opinions as required.

Chapter 5 Corporate Governance Structure

- The Company has selected a company with an Audit & Supervisory Committee for its structural design, and conducts systematic audits of the execution of duties by Directors. In addition, in accordance with the provisions of the Articles of Incorporation, Directors are entrusted with significant decisions concerning business execution in order to accelerate management decisions.

- In addition to the structure outlined in the previous paragraph, the Company established the Management Conference consisting of Directors, Executive Officers and others as an advisory body to a Director (President), who is entrusted with significant decisions concerning business execution.

- The Management Conference deliberates on reports on significant matters relating to management for the purpose of assisting decision-making by the Director (President) and increasing the flexibility of business execution.

- In addition to the preceding paragraph, the Company has established the Sustainability Committee to work on the promotion of CSR activities; the Group PDCA Council to undertake management planning for the entire Group as well as provide confirmation and guidance on the progress of important projects; and Regional PDCA Councils in Japan, the United States, Europe, China and Asia, and is working to ensure the transparency of Group management in a global capacity, and to strengthen corporate governance.

In accordance with the provisions of the Companies Act, the Company passes a resolution on the Basic Policy for the Establishment of an Internal Control System at a meeting of the Board of Directors, and creates an internal control system accordingly. Each year, the Company confirms the implementation status of the internal control system and reports the results to the Board of Directors, working to strengthen corporate governance by tackling improvements to the system.

- As a decision-making body for the management of the entire Group, the Board of Directors determines matters stipulated in laws, regulations and the Articles of Incorporation as well as basic matters for business execution, and also oversees the execution of business by Directors.

- Matters requiring resolution by the Board of Directors are those matters that are stipulated in laws, regulations and the Articles of Incorporation, and those matters that are stipulated in the Regulations of the Board of Directors.

- It is stipulated that decisions other than matters stipulated in the previous paragraph are delegated to the Director (President) who is entrusted with significant decisions concerning business execution for the purpose of accelerating management decisions.

- The progress of the mid-term management plan determined by the Board of Directors is reported to, and its status shared at, general meetings of shareholders and results briefings, etc.

- The successor to the Chief Executive Officer is systematically trained, including by systematic assignment to internal strategic departments for the purpose of developing a career as a manager, and the Board of Directors plays a supervisory role.

- Appointments and dismissals of a Chief Executive Officer are sufficiently discussed by the Board of Directors.

- In order to exercise prompt and decisive decision-making in accordance with global environmental changes, and to ensure the diversity of opinions, the Articles of Incorporation stipulate that the appropriate number of Directors is not more than 17, of whom not more than five are Directors serving as Audit & Supervisory Committee Members.

- Directors are appointed based on their ability to monitor and oversee company management from a global perspective, and their abilities, insight and experience necessary to make business decisions.

- When deemed necessary, the Board of Directors may invite persons other than Directors to attend meetings of the Board of Directors and request their opinions or reports.

- Unless otherwise stipulated by laws and regulations, the meetings of the Board of Directors shall be convened and chaired by a Director predetermined by the Board of Directors.

- In the event of an accident occurring with the Director stipulated in the previous paragraph, the meetings of the Board of Directors shall be convened and chaired by other Directors in a predetermined order.

- The Board of Directors sets an annual schedule, and basically operates on a schedule whereby all Directors can attend meetings.

- Convocation notices of meetings of the Board of Directors are issued to Directors at least three days prior to the date of the meeting. However, in the event of an emergency, this period may be shortened.

- Meetings of the Board of Directors may be held without the convocation procedure, provided that all Directors agree.

In order to ensure the effectiveness of the Board of Directors, each year the Board of Directors conducts a survey for Directors (including Audit & Supervisory Committee Members), analyzes and evaluates the surveys at a meeting of the Board of Directors, and implements specific improvements based on the results. In addition, the results of the surveys are disclosed by means of disclosure materials, including Integrated Reports.

- The Nomination and Compensation Committee is established under the Board of Directors as an advisory body for the purpose of strengthening the fairness, transparency, and objectivity of procedures related to the nomination and compensation for Directors (excluding Directors serving as Audit & Supervisory Committee Members) and Executive Officers.

- The Nomination and Compensation Committee consists of three or more members and the majorities of the members are independent Outside Directors.

- The chairperson and members of the Nomination and Compensation Committee are selected by resolution of the Board of Directors.

- The Nomination and Compensation Committee, in response to the inquiry of the Board of Directors, reports to the Board of Directors on matters related to the selection of candidates for Directors, and the decision policy of compensation for Directors and each Director.

- The Audit & Supervisory Committee audits the execution of duties by Directors and prepares audit reports.

- The Audit & Supervisory Committee determines the details of proposals regarding the appointment, dismissal, and non-reappointment of Independent Auditors.

- The Audit & Supervisory Committee determines the opinions of the Audit & Supervisory Committee with regard to the appointment, dismissal, or resignation of Directors (excluding Directors serving as Audit & Supervisory Committee Members), and states these opinions at the general meeting of shareholders, as necessary.

- The Audit & Supervisory Committee determines the opinions of the Audit & Supervisory Committee with regard to compensation for Directors (excluding Directors serving as Audit & Supervisory Committee Members), and states these opinions at the general meeting of shareholders, as necessary.

- Based on the Companies Act, Directors are selected at the general meeting of shareholders by distinguishing between Directors serving as Audit & Supervisory Committee Members and Directors not serving as Audit & Supervisory Committee Members.

- Resolutions for the selection of Directors are not based on cumulative voting.

- The roles of Outside Directors are to provide management oversight functions required by the Company, and to contribute to the deepening of deliberations by the Board of Directors, etc. with questions from a perspective that is independent from management and advice backed by extensive experience.

- In the event of conflicting interest transactions, Outside Directors express their opinions from the perspective of shareholders.

- Outside Directors shall ensure there is sufficient time to appropriately execute their duties when performing those duties after gaining a full understanding of the roles expected of them.

- Outside Directors will select a lead outside director through mutual election, and establish a system that enables communication and coordination among management and Audit & Supervisory Committee Members. In addition, Outside Directors exchange information and opinions based on a standpoint independent from business execution by holding meetings attended only by Outside Directors and conducting free discussions.

- All of the Company’s Outside Directors are registered as Independent Officers with the Tokyo Stock Exchange, and each one engages in highly effective management audits and oversight from an independent standpoint.

The Company has established an Independence Criteria for Outside Officers (Outside Directors and Outside Audit & Supervisory Committee Members). In the event that an Outside Officer does not fall under any of the items in Attachment 2, the Outside Officer is deemed to possess independence from the Company, and that no conflict of interest with general shareholders will arise.

- Director compensation and other property benefits received from the Company as consideration for the execution of duties (hereinafter, “compensation, etc.”) shall be determined by resolution of the general meeting of shareholders within the maximum amount by distinguishing between Directors serving as Audit & Supervisory Committee Members and Directors not serving as Audit & Supervisory Committee Members.

- Director compensation is intended to contribute to continual improvement of the Company’s business performance and corporate value. The Company designs its compensation system so that the level and structure of compensation are in accordance with the roles and responsibilities required of the Company’s Directors, and enable the recruitment and retention of well-qualified people.

- Director compensation consists of base compensation, performance-linked compensation, and restricted stock compensation. However, compensation for Part-time Directors, Directors serving as Audit & Supervisory Committee Members, and Outside Directors consists of base compensation only.

- The Company has established the Audit Department as an internal auditing unit, auditing major domestic subsidiaries as well as auditing overseas subsidiaries and monitoring the status of audits.

- The Audit Department conducts internal audits of the business execution by each department within the Group and the status of compliance and risk management, and reports the results to Representative Directors and Audit & Supervisory Committee Members.

- When appointing a new Director (including an Audit & Supervisory Committee Member), the Company ensures that divisions provide explanations regarding the business and operations to enable the Director to acquire the knowledge necessary to fulfill his or her roles and responsibilities, and provides opportunities for the Director to visit major offices and plants.

- After a new Director assumes office, the Company provides opportunities and arrangements for him or her to attend seminars and exchange meetings that are suited to individual directors, and provides support for the costs involved.

A Director who intends to engage in a competitive transaction or conflicting interest transaction shall disclose important facts related to the said transaction in advance to the Board of Directors (in the event of a conflicting interest transaction, to the Board of Directors and the Audit & Supervisory Committee) and obtain their approval. In the event that the transaction has already occurred, the Director shall report important facts related to the said transaction to the Board of Directors without delay.

- The Company ensures that officers and employees engage in business activities and conduct in compliance with laws, regulations and ethics.

- The Officer responsible for Corporate Planning is in charge of updating the Compliance Code of Conduct booklet, and instructs each individual to practice responsible behavior.

- Each Group company establishes a risk management system. For material risks, the Sustainability Committee examines appropriate countermeasures for the Group as a whole and reports them to the Board of Directors.

- The Company has established internal and external contact points to receive inquiries and reports related to compliance, and strives for early detection and early countermeasures with regard to illegal actions. In addition, we operate a system to prevent whistleblowers from suffering any disadvantage, in accordance with the Whistleblower Protection Act.

- The internal whistleblower system applies to officers and executive officers of domestic Sanwa Group companies, employees who have an employment relationship with any of these companies (including full-time employees, career employees, senior employees, temporary employees, and part-time clerical employees) and dispatched employees and subcontractors (i.e.construction engineers, subcontracted designers, and subcontracted workers dispatched to Company plants).

- In the United States and Europe, ODC and NF have their own internal whistleblower systems for all employees, while our affiliated companies in China and Asia operate whistleblower systems via websites that incorporate the internal whistleblower system in Japan.

- Inquiries and reports received in Japan and overseas are reported to the Board of Directors.