(As of June 27, 2024)

Status of Compliance with the Corporate Governance Code

The Company has implemented each principle of Japan's Corporate Governance Code. In addition, this report is based on the revised code (including the content for the Prime Market).

Corporate Governance Report

This is the corporate governance report submitted to the Tokyo Stock Exchange.

Corporate Governance Report (Last updated in June 27, 2024)![]()

Improving the Effectiveness of the Board of Directors and Audit & Supervisory Committee

Board of Directors

In fiscal 2023, the Board of Directors met eight times (seven regular meetings, one extraordinary meeting). The Board receives reports and makes swift decisions on important matters related to management and business execution.

Result of Evaluations of Board of Directors’ Effectiveness (Overview)

The Company has been conducting a questionnaire on the effectiveness of the Board of Directors after the conclusion of Board of Directors’ meetings at the end of each fiscal year since fiscal 2017. In fiscal 2023 as well, we conducted the questionnaire after the end of the meeting of the Board of Directors held in March 2024 and obtained responses from all directors, and at the first Board meeting in fiscal 2024 they analyzed and evaluated effectiveness based on the response results. The results of analysis and evaluation are as below.

■Board of Directors’ Evaluation Implementation Guidelines

Subjects of evaluation: All ten fiscal 2023 directors

Implementation method: Anonymous survey (freedom to express own opinions)

Question content: 30 questions in all, related to the composition, function and roles of Board of Directors, activation of deliberation at Board of Directors’ meetings, the operation status of the Board of Directors, sustainability and the self-evaluation of directors.

Evaluation Method: Compilation of questionnaire results, implementation of comparative aggregation with previous year

The results of the questionnaire were reported at a Board of Directors’ meeting and, based on the response results, the evaluation with regard to the Board’s effectiveness was confirmed.

【Content that could be evaluated】

The composition of the Board of Directors of the Company is well-balanced in terms of knowledge, experience and abilities and directors engage in productive discussion according to their respective skills. Therefore, the evaluation showed that the Board of Directors is generally functioning effectively.

【Points to be improved】

At the same time, we recognize that there are issues that continue to require improvement and that further efforts, such as reviewing the way information is provided to the Board of Directors, are needed to further enhance constructive discussions.

Directors

By resolution at the 89th Ordinary General Meeting of Shareholders held on June 26, 2024, the Board of Directors has nine directors (including three directors who are Audit & Supervisory Committee members), and for four (44%) of them we have submitted the list to the Tokyo Stock Exchange as independent outside directors. Candidates for directorships are selected based on individual abilities, insight, and experience as well as in consideration of the balance of the overall Board of Directors and the Audit & Supervisory Committee, diversity, etc. (At least one person who is an expert in finance and accounting is appointed as a director serving on the Audit & Supervisory Committee.) A decision will be made on the candidates following verification by the Audit & Supervisory Committee and an ensuing discussion by the Board of Directors. The dismissal of executive management and directors uses the same procedure, with the final decision made after deliberation by the Board of Directors.

| No. of directors stipulated in the Articles of Incorporation | 17 |

|---|---|

| Term of members of the Board stipulated in the Articles of Incorporation | 1 year |

| Chairperson of meetings of the Board of Directors | President |

| No. of directors | 9 |

| Election of outside directors | Elected |

| No. of outside directors | 4 |

| No. of outside directors designated as independent directors | 4 |

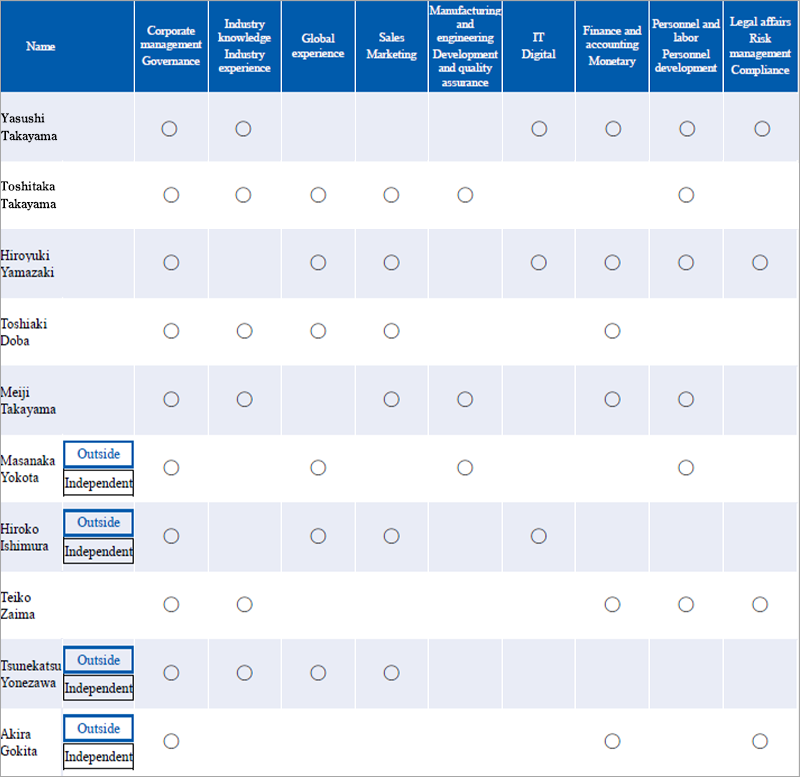

Skill Matrix

Reasons for Appointment of Outside Directors

| Name | Audit & Supervisory Committee member | Independent outside director | Supplementary Explanation | Reasons for Selection |

|---|---|---|---|---|

|

Masanaka Yokota Number of Board of Directors meetings attended: 8 |

◯ | Mr. Masanaka Yokota has been working for JMA Consultants Inc. The Sanwa Group has no business relationship with the company, but it receives education and training services (dispatch of lecturers, etc.) from JMA Group companies. However, concerning transactions between the Sanwa Group and the JMA Group, the average transaction amount for the past three fiscal years was less than 1% of the annual consolidated net sales of each of the Sanwa Group and the JMA Group, and the Company has determined that he has no conflict of interest with ordinary shareholders. | As a consultant for many years at JMA Consultants Inc., Mr. Masanaka Yokota provided advice and guidance for improvements and reforms in areas such as management strategy, production & manufacturing, and personnel development. Since he assumed office as an outside director in 2020, he has utilized his experience as a consultant and as the president of an overseas subsidiary, etc. to provide advice and suggestions on management as a whole, while also providing impartial opinions as a member of the Nomination and Compensation Committee. The Company expects him to utilize this extensive experience and knowledge to continue to provide supervision and advice in relation to the execution of duties by directors of the Company. | |

|

Hiroko Ishimura Number of Board of Directors meetings attended: 8 |

◯ | Ms. Hiroko Ishimura fulfills the Independence Criteria for the Company’s outside officers and the requirements for an independent officer as provided for by the Tokyo Stock Exchange, and the Company has determined that she has no conflict of interest with ordinary shareholders. | After first being employed by The Mitsubishi Bank, Ltd., Ms. Hiroko Ishimura joined Cincom Systems Japan Ltd. in 1991, where she held important positions, including those of Marketing Manager, Managing Director, and Representative Director. Since she assumed office as Outside Director of the Company in 2022, she has utilized her deep knowledge of solving business problems using IT and digital technologies, etc. and extensive experience as a corporate manager to provide advice and suggestions on management as a whole. The Company expects her to utilize these deep knowledge and extensive experience to continue to provide supervision and advice in relation to the execution of duties by Directors of the Company. | |

|

Tsunekatsu Yonezawa Number of Board of Directors meetings attended: 8 Number of Audit & Supervisory Committee meetings attended: 10 |

◯ | ◯ | Mr. Tsunekatsu Yonezawa is a former employee of Marubeni-Itochu Steel Inc. (MISI), which has a business relationship with the Sanwa Group. The Sanwa Group and the MISI Group have transactions involving the Sanwa Group’s purchase of raw materials and the sale of Sanwa Group products. However, the amount of transactions between the Sanwa Group and the MISI Group accounted for less than 1% of annual consolidated net sales of each of the Sanwa Group and the MISI Group in each of the past three fiscal years. Therefore, the Company determined that he satisfies the independence criteria for the Company’s outside officers and has no conflict of interest with ordinary shareholders. |

Mr. Tsunekatsu Yonezawa served as General Manager of Thin Plate Department I, ITOCHU Corporation, and General Manager of Oceania, ITOCHU Corporation, before being appointed the Member of the Board of Marubeni-Itochu Steel Inc. in the ITOCHU Group. Subsequently he assumed office as Outside Corporate Auditor of the Company in 2015, and Director serving as Audit and Supervisory Committee Member in 2016. At the Company, based on his experience as a corporate manager both in Japan and overseas and his deep knowledge of economics and management, he has provided appropriate opinions and advice while also providing impartial opinions as a member of the Nomination and Compensation Committee. The Company expects him to utilize his experience and knowledge to continue to provide appropriate supervision of execution of business by the Company. |

|

Akira Gokita Number of Board of Directors meetings attended: 8 Number of Audit & Supervisory Committee meetings attended: 10 |

◯ | ◯ | The Company had a legal consultation agreement with Mr. Gokita until December 2015, but the contract has since been terminated. For the duration of the agreement, the monthly legal fees paid to Mr. Gokita were ¥100,000 (there was no payment for compensation outside of the advisory agreement). Therefore, the Company determined that Mr. Gokita meets the independence criteria for the Company’s outside directors and has no conflict of interest with ordinary shareholders. | After serving as Public Prosecutor in the Special Investigation Divisions of the Tokyo District Public Prosecutors Office and the Osaka District Public Prosecutors Office, Mr. Akira Gokita registered as attorney at law in 1988, and since 1994 he has been active in a wide range of fields as an attorney at law for Gokita and Mitsuura Law Office. He assumed office as a director serving as an Audit and Supervisory Committee member of the Company in 2016. At the Company, based on his deep knowledge as a legal specialist, he has provided appropriate opinions and advice in relation to the governance and risk management of the Company while also providing impartial opinions as a member of the Nomination and Compensation Committee. Other than as an outside director he has had no involvement in company management, but the Company expects him to utilize the above-mentioned experience and knowledge to continue to provide appropriate supervision of execution of business by the Company. |

Audit & Supervisory Committee

The Audit & Supervisory Committee met ten times in fiscal 2023. Directors on the Audit & Supervisory Committee monitor the status of business execution by directors who are not Audit & Supervisory Committee members and executive officers, and then they report and express their opinions to the Board of Directors. In this way, we work to ensure legal and appropriate corporate management. We believe that the transition to a company with an audit & supervisory committee has contributed to improving the supervisory role and transparency of the Board of Directors, and that this demonstrates the effectiveness of the Board.

Committee Composition and Chairperson

| Total Number of Members | Full-time Members | Internal Directors | Outside Directors | Chairman | |

|---|---|---|---|---|---|

| Audit & Supervisory Committee | 3 | 2 | 1 | 2 | Internal Directors |

| Directors and employees who support the work of the Audit & Supervisory Committee | Yes |

|---|

Policies for Determining Compensation Amounts of Directors and Audit and Supervisory Committee Members

Compensation of Directors

| Base compensation | Short-term incentive Performance-linked compensation |

Long-term incentive Restricted stock compensation |

|

|---|---|---|---|

|

Directors (excluding directors serving as Audit & Supervisory Committee Members) (excluding outside directors) |

¥380 million or less per year |

¥280 million or less per year |

¥80 million or less per year |

|

Outside Directors (excluding Audit & Supervisory Committee members) |

|||

| Directors serving as Audit & Supervisory Committee members |

¥100 million or less per year |

- 1. Basic concept

- Compensation, etc. of directors and Audit and Supervisory Committee members is intended to contribute to continual improvement of the Companyʼs business performance and corporate value. The Company designs its compensation system so that the level and structure of compensation are in accordance with the roles and responsibilities required of the Companyʼs directors and Audit and Supervisory Committee members, and enable the recruitment and retention of well-qualified people. The compensation of directors consists of base compensation, performance-linked compensation, and restricted stock compensation. However, directors serving as Audit and Supervisory Committee members and outside directors are only paid base compensation. Furthermore, in principle, compensation is not paid to part-time directors (directors who are paid compensation from consolidated subsidiaries). The total amount of base compensation and performance-linked compensation and the total amount of restricted stock compensation shall be within the total amount determined at General Meetings of Shareholders.

- 2. Base compensation

- The base compensation for each director (excluding directors serving as Audit and Supervisory Committee members) is set for each position based on consolidated performance with reference to the compensation levels of other companies presented by a specialized outside organization and paid monthly.

- 3. Performance-linked compensation

-

For performance-linked compensation, as monetary compensation for business execution during the term (1 year) of directors, a standard amount is set for each position based on the Company’s consolidated performance with reference to the compensation levels of other companies presented by a specialized outside organization. The standard amount of this type of compensation is determined by taking into account standard amount indicators and the levels of contribution of each director, evaluated quantitatively and qualitatively, and the compensation is paid during the fiscal year following the fiscal year under review.

As far as serving as a reward that functions as a sound incentive for sustainable growth that reflects the Company’s business performance is concerned, consolidated operating income has been selected as the primary indicator of performance-linked compensation.

The amount of performance-linked compensation is determined as the amount calculated by multiplying the number of points specified for each position by the unit prince of points, and then by individual evaluation that reflects the evaluation of each director. The unit price of points for the fiscal year under review is calculated by multiplying the unit price of points for the previous fiscal year by the percentage change in consolidated operating income from the previous fiscal year (percentage derived by dividing consolidated operating income for the fiscal year under review by consolidated operating income for the previous fiscal year) by the amplification factor set to raise incentives, and is determined by approval of the Board of Directors.

Individual evaluations are conducted by setting multiple priority targets for each director individually, and evaluating them quantitatively and qualitatively through the PDCA (plan–do–check–act) cycle. In addition to these individual priority targets, items that contribute to the sustainable growth of the Company, such as “revitalization of the organization, compliance, and creation of a comfortable working environment,” are set as common priority targets for all directors.

In addition, individual evaluation of each director is made and determined by the Representative Director, President, delegated by the Board of Directors through quantitative and qualitative measurement of his or her job performance and degree of contribution by ±25% for each evaluation item.

Performance-linked compensation of individual directors (formula) = number of points x unit price of points x individual evaluation

Number of points: determined for each position Unit price of points: unit price of points for the previous fiscal year x percentage change from the previous fiscal year x amplification factor Individual evaluation: ±25% - 4. Non-monetary compensation (Restricted stock compensation)

- The restricted stock compensation plan is stock compensation plan aimed at providing incentives to directors for sustainable improvement of the corporate value of the Company as well as promoting further value sharing between directors and shareholders.

Directors, excluding outside directors and directors serving as Audit and Supervisory Committee members, are eligible, and the specific allocation paid to each eligible director is decided based on a resolution by the Companyʼs Board of Directors.

Each eligible director shall pay all claims for monetary compensation to be paid for granting restricted stock in the form of properties contributed in kind each fiscal year and shall receive allotment of common stock of the Company. Furthermore, restricted stock compensation shall be granted as compensation for duties performed during the term (1 year) of directors within one month after the conclusion of the Ordinary General Meeting of Shareholders in which the directors were elected. The allotment will be made through the disposition of treasury stock.

The transfer restriction period shall be the period from the date of delivery of restricted stock to the time that directors lose their positions as director of the Company or any other positions determined by the Board of Directors of the Company. - 5. Proportion of amounts of compensation paid to individual directors for base compensation, performance-linked compensation and non-monetary compensation

- The proportion of different types of compensation paid to directors is based on compensation level benchmarks of companies with similar business scales and belonging to the related industry and business category as the Company and through consultation with the voluntary Nomination and Compensation Committee, and is determined by the Board of Directors based on the advice of the committee.

The model case for the proportion of base compensation, performance-linked compensation and non-monetary compensation is 45% : 40% : 15%. However, the proportion of actually paid amount may vary with individuals.

Base compensation (45%)

Performance-linked compensation (40%)

Non-monetary compensation (15%) - 6. Policies related to decisions on the details of compensation, etc. for individual directors

- Based on a resolution by the Board of Directors, the Representative Director, President is delegated authority to decide the specific details of the amounts of individual compensation. The scope of that authority covers the amount of base compensation for each director and the evaluation and allocation of performance-linked compensation based on the business performance of the business for which the individual director is responsible. However, so that the Representative Director, President appropriately uses this authority, the Board of Directors will consult with the Nomination and Compensation Committee on items related to the calculation method, etc. of individual compensation and receive advice from the committee. The delegated Representative Director, President will then consider the details of this advice and decide.

Through having the amount of compensation for individual directors reported to the Nomination and Compensation Committee and validated by the committee, its fairness, transparency, and objectivity is ensured. - 7. Shareholding guidelines

- On April 1, 2023, the Company established the following shareholding guidelines with the aim of having directors share the merits and risks of stock price fluctuations with shareholders, and further increasing motivation of directors to improve business performance by encouraging directors of the Company (excluding outside directors, part-time directors and directors serving as Audit and Supervisory Committee members) to hold the Company's shares.

<Guidelines>

Each director shall endeavor to hold the Company's shares in accordance with the basic amounts presented below.

Chairman/President/Senior Advisor: 2 x base compensation (annual amount) within four years after assuming office of one of the said positions.

Other directors: 1 x base compensation (annual amount) within four years after assuming office as director. - 8. Other important items related to decisions on the details of individual compensation, etc.

- N/A

Overview of Compensation (Fiscal 2022)

| Classification | Total Compensation (Millions of yen) |

Total Compensation by Type (Millions of yen) |

Number of Officers Eligible | ||

|---|---|---|---|---|---|

| Base Compensation | Performance-Linked Compensation | Non- monetary Compensation |

|||

| Directors (excluding directors serving as Audit & Supervisory Committee members and outside directors) |

388 | 142 | 193 | 52 | 4 |

| Directors serving as Audit & Supervisory Committee members (excluding outside directors) |

37 | 37 | - | - | 1 |

| Outside directors (excluding Audit & Supervisory Committee members) |

22 | 22 | - | - | 2 |

| Outside directors (Audit & Supervisory Committee members) |

47 | 47 | - | - | 2 |

- The amount paid to directors does not include the portion of employee’s salary for those directors who concurrently serve as employees.

- Performance-linked compensation adopts the Company’s consolidated operating income as the performance indicator to explicitly reflect profitability of the business activity in the fiscal year ended March 31, 2022, and the said compensation is calculated by determining a base amount for each position based on consolidated operating income compared to the previous year, then adding or subtracting the contribution of each director within a range of ±25% to the base amount.

- Non-monetary compensation is included in the amount recorded in the current fiscal year related to restricted stock compensation. Under restricted stock compensation plan, the Company’s common stock allocated under restricted stock allocation contract shall not be transferred, pledged or disposed in other ways from the allocation date to the day on which the directors or persons in any other positions designated by the Board of Directors of the Company lose their positions. In addition, in case the directors lose their positions designated by Board of Directors by the end of the period separately designated by the Board of Directors of the Company, the Company may obtain restricted stocks allocated to the directors without any charge and any conditions, except the case in which the Company’s Board of Directors considers that there is any legitimate reason.

- The compensation limit for directors (excluding directors serving as Audit & Supervisory Committee members) is \660 million per year (as approved at the 86th Ordinary General Meeting of Shareholders held on June 22, 2021). The number of directors as of the close of this Ordinary General Meeting of Shareholders is 6 (including 1 outside director).

- Aside from 4. above, the compensation limit related to restricted stock compensation for directors (excluding outside directors and directors serving as Audit & Supervisory Committee members) is \80 million per year (as approved at the 86th Ordinary General Meeting of Shareholders held on June 22, 2021). The number of directors (excluding outside directors and directors serving as Audit & Supervisory Committee members) as of the close of this Ordinary General Meeting of Shareholders is 5.

- The compensation limit for directors serving as Audit & Supervisory Committee members is \100 million per year (as approved at the 81st Ordinary General Meeting of Shareholders held on June 28, 2016). The number of directors serving as Audit & Supervisory Committee members as of the close of this Ordinary General Meeting of Shareholders is 3 (including 2 outside directors).

- For a part-time director, no compensation etc. is paid from the Company.

- The Company’s Board of Directors delegate the authority to decide individual compensation etc. of directors to the Representative Director, President to appropriately evaluate their performance based on the business performance of the entire Company’s group. The scope of the authority of the delegated Representative Director, President covers the amount of base compensation for each director and the evaluation and allocation of performance-linked compensation based on the performance of the business for which the individual director is responsible.

- For the amount of individual compensation of each director in the current business year, the Representative Director, President consults with the Nomination and Compensation Committee on items related to the calculation method etc. of individual compensation and receives advice from the committee and decides the amount in consideration of the advice. The Board of Directors judges that the decision is made in accordance with the policies above.